Investing in Urban Footprint to leverage data to make our cities more resilient

By Rahul Parekh

Cities cover roughly 1% of the earth’s landmass but are home to over 50% of the world’s population and are responsible for 70% of global emissions. As a result, cities are acutely exposed to the impacts and risks of climate change from increasing mean temperatures, to changes in patterns and severity of precipitation to droughts and flooding. Not surprisingly, the most rapid growth in urban vulnerability to climate change has been in those areas with the least adaptive capacity — often the poorest areas.

Our global investment into urban adaptation to climate change is insufficient. In developing countries alone, UNEP estimates an annual investment need of $70 billion now and up to $500 billion in 2050. Despite these huge numbers, policymakers, planners, municipal governments, utilities and other urban stakeholders often lack the insights and ability to target spending towards the areas most at risk to climate change and urban challenges.

In 2014, Joe DiStefano and Peter Calthorpe decided to solve this problem and find a scalable way to make cities more resilient across the globe. They used their decades of experience in urban design and planning to develop the tools that would become Urban Footprint, the world’s first urban intelligence platform.

At 2150, we first came across Urban Footprint during our analysis of the climate intelligence market. Until meeting Joe, we’d struggled to find ‘actionability’ in the data driven business models we’d been seeing. Yes it was great to use big data analytics, AI and machine learning to understand climate risk, but what next?

What we needed were actionable insights to really drive decision making. After meeting Joe and seeing Urban Footprint in action, we knew we needed to invest. The Urban Footprint product was exactly what we were looking for; superior, productised intelligence with actionable insights to allow institutions that are planning and building the world’s infrastructure to make urban environments more resilient.

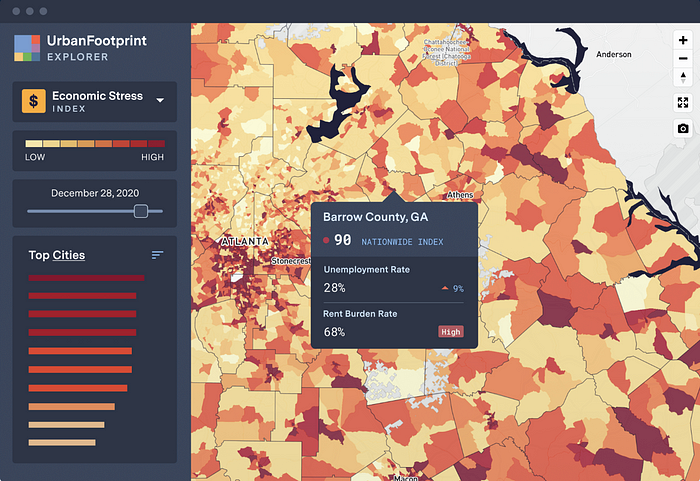

What makes Urban Footprint so exciting is its ability to translate risk information into human impacts and vulnerability. While destruction of buildings, grids and coastal infrastructure is important from an infrastructure perspective, the main underlying concern is about the populations that will be affected by these failures or risks. Urban Footprint excels by measuring the range of population that would be affected by disruption or benefit from improved services, and most importantly their socio-economic characteristics. This economic layer helps decision makers target their spending or policies on populations that have the least ability to adapt or recover from disruption, or those particularly vulnerable or underserved.

Funding for adaptation is limited. The Climate Policy Initiative estimates that only $46 billion of annual climate finance was allocated to adaptation in 2019/2020. To increase resilience, spending must be targeted to deliver maximum benefits in terms of both infrastructure and human vulnerabilities. Urban Footprint equips utilities, governments and service providers with multi-dimensional analyses to pinpoint where capital can most effectively increase the resilience of urban systems. Factors such as flood and fire risk, population affected in the case of outage, age of infrastructure and socio-economic factors can be weighed together to ensure limited budgets go furthest.

Urban Footprint also helps to break down data silos. For example, a major hurdle to overcoming food insecurity and eviction risk in the U.S. is that these aid systems are deeply fragmented, made up of a diverse set of agencies at the federal, state and local levels and community organisations and programs that are largely siloed. This results in a critical information gap on the scope and impact of relief efforts, and much of the data that is relied upon is outdated. For instance, Feeding America data is updated annually. To solve problems that affect millions of Americans daily and can quickly change based on factors like employment and income, timely data is key.

This data silo problem is also highly relevant to the decarbonisation of cities. In the United States, 53% of greenhouse gas emissions are dependent upon the nature of our buildings and our transportation. In the coming urban transformation, our land use and infrastructure choices will play a critical role in not only our ability to curtail emissions and mitigate the impacts of climate change, but also our success in fostering equitable, sustainable, and economically strong communities.

Timely, relevant data that is categorised, normalised and visualised will empower urban planners, developers and government decision makers with actionable insights to use when they are making the decisions that affect millions of citizens.

Joe and the Urban Footprint team have proven that their product is applicable across many industries. Today the product is being used by the world’s largest utilities to plan grid infrastructure investment and EV charger deployment, as well as the world’s largest financial institutions to manage municipal bonds and real asset portfolios. Most importantly, Urban Footprint has been trusted by governments to help plan the cities of tomorrow.

Investments in climate resilience solutions like Urban Footprint are critical for venture capital to support the goals of the Paris Agreement. At 2150, we are delighted to invest in Urban Footprint’s latest fundraise alongside our friends at Citi Ventures, Valo Ventures, A/O Proptech and Social Capital, and we can’t wait to support Joe and the team in the journey ahead.

________

2150 is a venture capital firm investing in technology companies that seek to sustainably reimagine and reshape the urban environment. 2150’s investment thesis focuses on major unsolved problems across what it calls the ‘Urban Stack’, which comprises every element of the built environment, from the way our cities are designed, constructed and powered, to the way people live, work and are cared for. Find out more at www.2150.vc