Sharing our insights into the biggest sustainability challenges facing our built environment. Our previous issues of the UNSUSTAINABLE series have focused on the often overlooked, but massive issues within cooling and windows. With today’s post, we explore the very foundations of the built environment: concrete and cement.

The Problem

After water, we use more concrete than any other material on the planet. Our global consumption of concrete stands at ~30 billion tonnes each year, relying upon the annual production of >4 billion tonnes of cement, concrete’s key binding ingredient.

But our mass addiction to cement and concrete comes with a significant carbon cost. The cement industry is responsible for ~2.5 Gt of CO2 emissions per year, equivalent to ~7% of CO2 emissions. If the cement industry were a country, it would be third largest emitter in the world after China and the US. Concrete also requires vast amounts of natural resources, for example, taking up almost 10% of industrial water usage.

Cement is often described as difficult to decarbonise. But with cement already responsible for such a high percentage of global emissions and future cement consumption expected to grow ~10–20% to 4.7–5.1 billion tonnes by 2050, this is a problem that needs to be solved urgently.

Emissions along the Value Chain

Cement is the key glue-like ingredient in concrete, binding together gravel and sand to form solid, set concrete.

While cement makes up just 7–15% of concrete, its production is responsible for 80–90% of concrete’s emissions. Cement is made by heating up limestone, along with other ingredients like clay and shale, to extreme temperatures (~1,450 °C) to produce clinker, a rock-like substance which is ground into a powder to form cement. This process has two key sources of emissions:

- When heated to very hot temperatures, limestone — a mix of calcium, carbon, and oxygen — decomposes and releases CO2. These “process emissions” are simply part of the chemical reaction of using limestone to make cement and make up >50% of cement’s overall CO2 footprint.

- For the kiln to reach such high temperatures, the process is typically powered by fossil fuels, which make up ~40% of cement’s overall CO2 footprint.

- The remaining <10% of cement’s CO2 footprint comes from other sources such as transportation, grinding, mixing, etc.

Solutions along the Value Chain

McKinsey forecasts that CO2 emissions from the cement industry could be reduced by 75% by 2050. However, only a small portion (~20%) will come from operational advances, while the remainder will need to come from technological innovation.

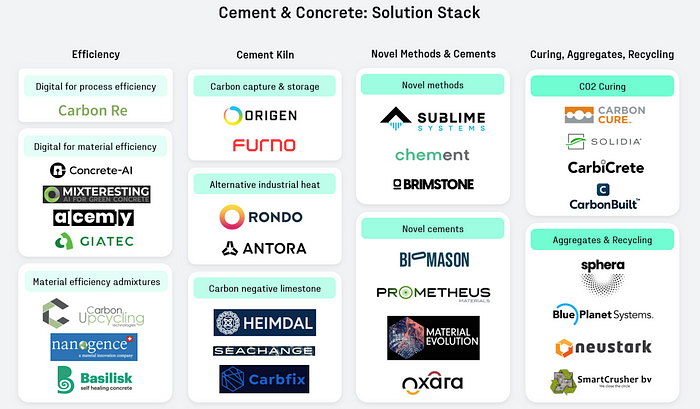

Rising to the challenge, an array of solutions is emerging along the value chain, with solutions starting even before the cement kiln (e.g., making carbon negative limestone or replacing the cement kiln altogether) and extending all the way to after demolition (e.g., recycling concrete as aggregate or recovering and reusing unhydrated cement):

The Market

Given the mass consumption of cement and concrete globally, these are large markets — on the scale of $300 billion for cement and $1 trillion for concrete. Globally, the largest market segment is ready-mix concrete, using an estimated ~50% of cement today, a figure which could rise to ~67% by 2030. Bagged cement is the next largest, making up ~42% of cement usage globally, but bagged cement’s market share decreases with increasing GDP per capita and is therefore expected to decline in the future. Lastly, precast concrete uses an estimated 4% of cement production. However, precast’s market share is growing, supported by cost and waste reduction vs. ready mix concrete, and could reach 6% of cement usage by 2030.

Both cement and concrete markets tend to operate locally, given high transport costs and low value to weight ratios. Indeed, in Europe, cement is usually supplied within a maximum 150–250km radius of the location of production. Globally, “only 5% of global cement consumption is traded.” Today, China is the largest producer of cement, accounting for 55% of global production, followed by India at 8%, the EU at 4%, and the US at 2% (2019 data from IEA, CEMBUREAU). Going forwards, India, “other Asia Pacific”, and Africa are increasingly expected to drive global cement production.

Challenges

Successful solutions will have to overcome a number of challenges:

- Competition. The cement industry is commoditized and suffers from overcapacity (capacity utilisation globally is <75%). As a result, the market is highly competitive. Costs — including those for decarbonisation innovations — are difficult to pass along.

- Cost. Even with product differentiation, low carbon cement will still need to be cost competitive. Although sustainability is becoming a growing corporate and societal concern, most businesses are still driven by cost.

- Capex. Cement is a capex intensive industry. To build an average sized cement plant requires hundreds of millions of dollars. In this context, many solutions are likely to be capex heavy.

- Regulation. Industry standards and building regulations will need to be revised for novel cements to see widespread adoption. As noted by Chatham House (2018), “Almost all standards, design codes and protocols for testing cement binders and concrete are based on the use of Portland cement.” For example, geopolymer cements are not permitted under building regulations in some countries because of a lack of supporting standards (EC, 2021). However, some regulatory support is emerging, with Sweden, Denmark, France, Finland and the Netherlands having introduced regulation on embodied carbon (see here).

- Existing infrastructure. The typical lifetime for a cement kiln is 40 years, while the average age of installed cement kilns globally is ~15 years (see below). With relatively young cement kilns globally, the most scalable solutions will either (1) be compatible with existing infrastructure and/or (2) offer significant cost savings relative to existing methods.

Our 2150 take

Given its trillion dollar scale and continued global use, cement & concrete decarbonization represents both a massive business opportunity as well as possibly one of the most actionable and scalable methods for reducing global CO2 emissions.

Decarbonising cement and concrete will require a “stack” of solutions versus a single one that will completely eliminate the sector’s emissions. With our investment in CarbonCure, we targeted concrete curing, where CO2 curing presents an immediate opportunity for decarbonisation impact with favourable economics helping to drive adoption. Our investment in Biomason honed in on the cement kiln, with Biomason’s biocement replacing the cement kiln with a bioreactor, reducing the CO2 emissions compared to OPC by about 90%.

Here at 2150, there’s more for us to learn in this sector and we’re still looking for more solutions along the stack. If you want to learn with us or if you’re creating new ways to decarbonise the cement and concrete industry, please reach out!

2150 is a venture capital firm investing in technology companies that seek to sustainably reimagine and reshape the urban environment. 2150’s investment thesis focuses on major unsolved problems across what it calls the ‘Urban Stack’, which comprises every element of the built environment, from the way our cities are designed, constructed and powered, to the way people live, work and are cared for. Find out more at www.2150.vc